The Reserve Bank of India must act speedily in making special efforts to undo legacy issues. The Government of India has borrowed heavily over the last 15 years. In the process, dealing with inflation at certain periods, the Reserve Bank of India independently took steps to increase the interest rates and established a higher interest rate regime for the whole nation.

It certainly made an impact on the markets; it made an impact on borrowing by the public. In fact, a re-examination of its impact must be done internally by the Reserve Bank as well as the Government of India.

In the period of four years, India had extremely high real interest rates as well as nominal interest rates compared to the rest of the world.

It is therefore an opportunity to correct this. The Government of India has been the worst hit victim and on behalf of people of India, it cannot be burdened by legacy issues even though it cannot manage it.

Reserve Bank of India has now within its means and tools, the capability of redressing these wrongs without hurting markets or its autonomy or position.

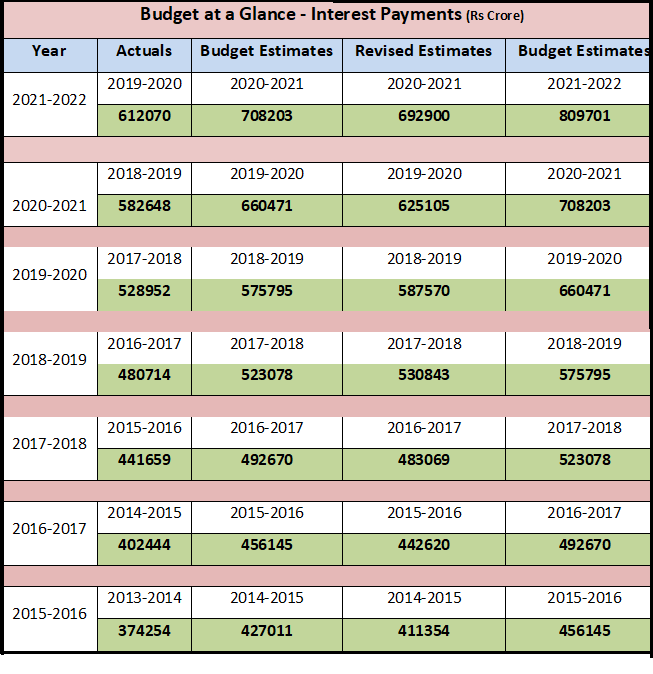

The table below reveals a substantial amount to Outgo of Interest by the Government of India.

a) Due to the increase in borrowings

b) Increase in rate of Interest

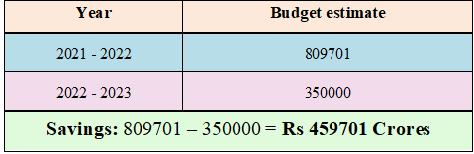

The Government of India needs to reduce the interest outgo from Rs 809,000 crores per year to Rs 350,000 crores for financial year 2022-23 and need not wait for prolonged periods.

The table below shows the flexibility of savings on interest payment.

RBI can take the following steps:

1) The total holdings of government securities that it has on its inventory, which is to the extent of Rs. 11,00,000 crores can be converted into Treasury Bills at a nominal interest rate of 0.25%. This can be proscribed as a national measure in an emergent situation. This is equal to the interest rate in the global situation and India’s position within 10 large economies. This can be for a tenor of 364 days and the Government of India will save instantly the total amount of interest pay-out this year and forever.

2) It is recommended that the Reserve Bank of India can buy back the outstanding oil bonds and convert it into normal securities like Treasury Bills at 3.35 percent. This can be done immediately in order to ensure the goal of reducing interest costs of the Government of India. The saving over the period of the Bonds is Rs 17,788 Crores.

3) The Government and Reserve Bank can work together so that Reserve Bank of India buys to the extent of Rs. 33,00,000 crores of securities.

These can be converted into –

o 182 days Treasury Bills @ 3.35%

o 91 days Treasury Bills @ 1.75%

o 46 days Treasury Bills @ 1%

o 14 days Treasury Bills @ .25%

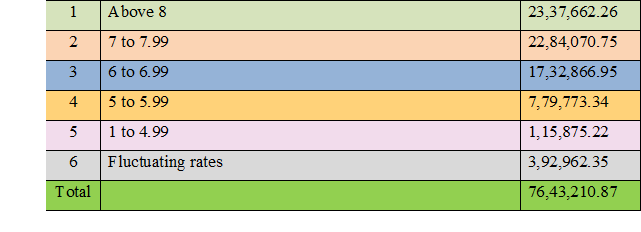

The table on list of Government of India securities outstanding as on 6th September 2021 is enclosed with this document. The list has been modified by making a table and the total outstanding in each of the interest rates is summarised here below.

Total Outstanding Securities at different interest rate slabs (Rs. Crore):

4) Reserve Bank of India within its purview can structure as a response to current global Indian factors as follows in the next 4 months as a borrowing structure:

• Treasury Bills Reverse Repo Rate less than 14 days Maturity 0.25%

• Treasury Bills Reverse Repo Rate less than 46 days 0.50%

• Less than 182 days 0.75%

• Less than 364 days 1.00%

5) The RBI Governor in a recent interview conveyed that interest rate on Reverse Repo is within its purview and not within the MPC. Therefore, Reverse Repo auctions can be restricted to Treasury Bills at the respective rates.

6) The Government of India and Reserve Bank of India can create the additional liquidity temporarily so that Government of India can manage to raise these resources for the current year at a low cost. To this end, for at least next 18 months it need not raise any long-term loans beyond 10 years.

7) When Government of India can turn at least 75 percent of its current outstanding, it can save Rs.4,00,000 crores of interest annually for the next 10 years.

The Government of India and RBI together should cognise that saving interest outgo is an exercise of convergence. It will help reduce revenue deficit and hence the fiscal deficit.

When the Government of India is affected, the whole nation gets affected.

RBI’s mission and mandate are for the people of India. The Reserve Bank of India and Government of India need to act to reduce the outgo of interest from the Government of India. This needs to be acted on expeditiously and the exercises and action needs to be in the current year.

Government of India will save Rs. 4,59,000 Crores when action is initiated within 4 to 6 weeks now without waiting for Budget 2022-23.

European nations are at negative interest rates and rest of OECD are at marginally positive interest rates at .25 to .75 percent.

It is therefore India’s moment to capture Rs 33,00,000 Crores equivalent of Rupee Debt at a cost between .25 to 3.35 percent for Treasury Bills by integrating the Forex Markets with the Bond Markets.

The balance of Rs. 40,00,000 crores also needs to be brought within the 4 to 4.75 percent range.

India will grow at 8 to 10 percent CAGR only when –

• Government expenditure comes down.

• Public consumption goes up.

• Capital goods for long-term can be accessed for future returns.

• High-cost debt as legacy is replaced by low-cost debt for all entities.

• Growth needs to be in middle class housing.

• Infrastructure and long-term finance are priced around 6.1 percent to 7.5 percent or lower, and stable for 10 to 30 years.

• Savers interests are protected by secured long-term debt.

• Inflation needs to have a balanced view.

These are some among the steps that are required to be taken and need to get collaborated with the real economy.

India will grow into a Rs 400 trillion economy when a series of actions are initiated for the medium and long-term.