Capital Account Convertibility – The Role of Indian Commercial Banks – Control, Regulation and Management – Indian Resources for India

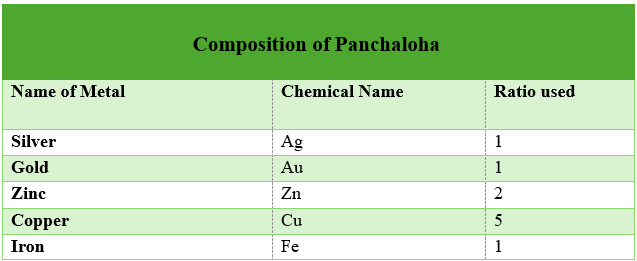

The role of Indian capital for India in metals is described below with prescriptions for Total Factor Productivity. India has been very active in mining and holding basic metals since ancient times. So much so that the term “Panchaloha” involved melting and casting five metals. Idols have been cast in Panchaloha since ancient times.

It is conclusive that the separation and mixing of metals was one of the biggest skills of Bharat and was widely applied in the making of weapons for defence, for ordinary use at palaces and homes. The degree of prosperity, from a household to a kingdom, or an article of common use within a community, was measured scientifically, and proportions held significance.

For example, brass, an alloy of copper and zinc, holds historical and sustainable importance due to its hardness and workability. Brass has been extensively used since 500 BC, and even today, it is one of the commonly used materials in the form of sheets.

PANCHALOHA

The concept of Panchaloha must be extended to the commercial banking sector, Investment Banks as well as Commercial Banks.

Individuals who have benefited from the growth in capital assets and have their own private investment agenda need to be encouraged to hold metal in Indian soil.

National Insurance Company of India can have its insurance business taken over by New India in a commercial deal, and Oriental Insurance can transfer its business to United India. National and Oriental can function as Investment Companies (sovereign) and be managed effectively. Kolar Gold Fields, RITES and chosen performing PSEs need to embrace the metals and energy portfolio as managers, owners and handlers of metal.

There need to be at least 16 entities embracing the real economy within the financial sector, either as holding companies or investment companies. They need to be multinational as well as multilateral, with close liaison, as now repeatedly declared – within the G20 and establishing a new order among nations.

These institutions need to be controlled, governed, and regulated.

Commercial Banks in India need to be compelled that 2% of the total commercial assets of the Commercial Banks of India, NBFCs, Cooperative Banks, and any entity holding

SLR securities must be allowed in physical metals and energy inputs.

The Reserve Bank of India, in a policy statement, should establish an entity overseeing how Capital Convertibility integrates with the holding of metals as a strategic reserve dealing with convertibility of the Rupee with all producing nations but also with nations that have strength in the institutions governing markets at financial centers:

a) Chicago, b) Perth, c) Paris, d) Frankfurt, e) Singapore, f) Tokyo, g) Dubai, h) Fortaleza in Brazil

Any nation that is a producer of a metal should establish a direct relationship of that currency in Gift City but also onshore in India. All commercial banks need to be involved in this activity in proportion.

The composition of Panchaloha metals are as follows:

(Table 1)

Source:

This composition may be for idols but Government of India and the Reserve Bank of India can develop a composition in national interest.

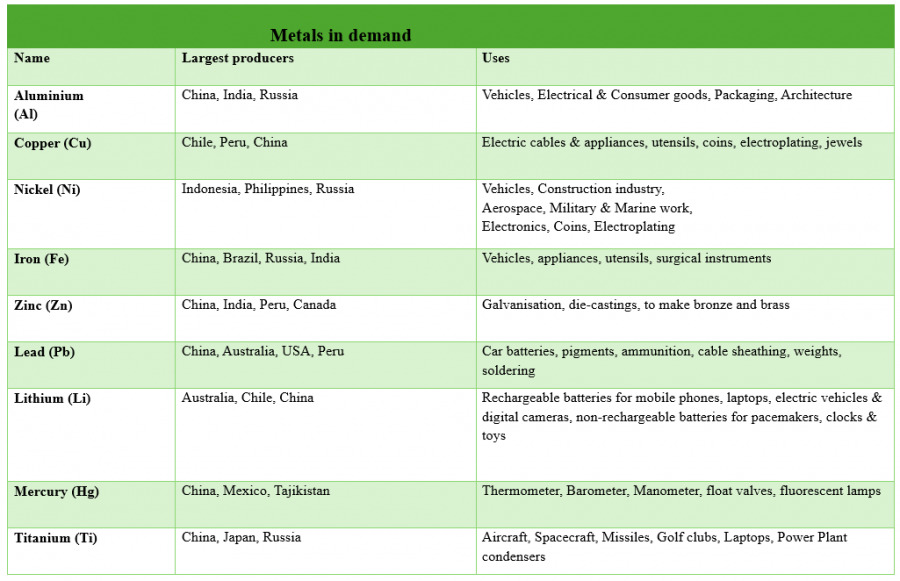

The other important metals that are always in demand are as follows:

(Table 2)

Source:

The below table is about exotic metals and minerals that go into the semiconductor or the specialist areas for the next 15 years.

(Table 3)

Trading in respective national currencies need to be addressed.

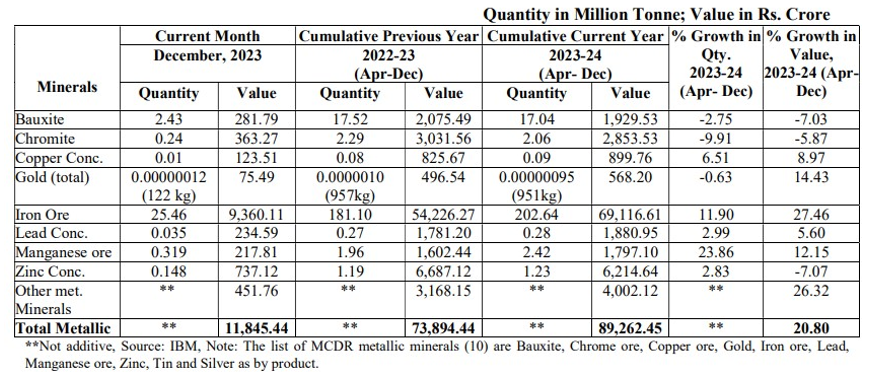

India’s Metal Production:

(Table 4)

Source:

https://mines.gov.in/admin/storage/ckeditor/_January_2024_1709620048.pdf

The energy inputs inventory can be of crude oil onshore, petroleum products, LNG and coal inventory at critical points of consumption.

The Government of India and the Reserve Bank of India should develop at least 90 centres as holding and development centres for these metals, and energy inputs at least at 1200 locations which need to be governed as follows:

All the centres should be guarded by the President’s bodyguard for bullion, while the Central Industrial Security Forces should guard other metals. (In India, bullion refers to precious metals such as gold and silver that are traded in bulk quantities, typically in the form of bars, ingots, or coins. In India, platinum is not traditionally considered as bullion in the same way as gold and silver.) Guarding formats for holding respective metals should be well determined.

The delivery centres should be spread across 70 locations in India to begin with. The RBI can initiate processes to convert Commercial Bank premises into “depositories.” Additional centres can be established at prominent Railway Stations and territories.

GIFT City should also have a depository with all commercial banks having equity interest and investing in common facilities.

For gold, there should be one centre for every district headquarters, with at least three Commercial Banks holding enough to supply 7 days’ requirements of that district. These centres need to be governed as Custom Bonded Territories with GST officials in deputations. An IRS officer of the Rank of Additional Secretary to the Government of India can be deputed to the Indian Banks Association as Executive Adviser to RBI, Ministry of Economic Affairs, and other institutions for a period of three years to establish SOPs and Work Instructions.

Market regulation falls under the State list of the Constitution of India.

Commercial Banks should appoint an Executive Director (Own Directors) solely for the purposes of asset management in securities and metals, with expertise developed over years capable of handling executive capacities, free of frauds and corruption. They should have the ability to control assets for disintermediation in approved centres.

The Reserve Bank of India and the Government of India must introduce guidelines equivalent to those of Singapore and Switzerland by leveraging their expertise in building strong rooms, access centres, security measures, CCTVs, and digital technology to ensure precise delivery of every unit of metal in caskets/boxes.

One joint venture from each nation’s bank and depository should be established with a 100 percent State Sector enterprise. For example, Kolar Gold Fields Limited has a joint venture with an Australian Bank and Depository, leveraging facilities around Kolar Gold Fields territory. Special purpose SEZs should be established for marine containers as well as metals – mined or virgin, and recycled – at various points in India, preferably at railway sidings.

Expertise in electronic boxes, such as those made by BEL for the Election Commission, should be replicated for gold, silver, and currency equivalents. These boxes should be exclusively transported by contract to the Indian Postal Service, Airlines, and Railways, using special carriages controlled through digital and analogue means from the logistics centre to the delivery points spread across the nation.

The Panchaloha principle involves a proportionate mixture of metals through melting and casting in amalgam. However, concerning the depository, each bank should propose a percentage allocation of each metal as a national policy. The Panchaloha principle implies a geometric proportion in value, eventually representing the total current assets of the Indian nation.

Deliveries to these centres can originate from domestic or imported sources. Once on the premises, standard prescriptions should be followed from production to storage. Trust levels, alongside consistency, should develop over time.

The Panchaloha principle also dictates that the Reserve Bank of India establishes a National Committee to anonymously fix the rupee equivalent value of each metal. This would enable all producers, importers, and exporters in India to follow these reference prices.

The Panchaloha principle involves disintermediation, allowing people in India to hold full or fractional certificates of Panchaloha issued by all Commercial Banks. These certificates, carrying no interest, operate akin to mutual funds, with valuations based on daily movements, thus enabling individuals to benefit from any escalation.

Commercial Banks need to establish individual and composite Panchaloha pricing, based on afternoon fixing. This process should automatically shuffle micro weights attributed to each metal, ensuring no manipulation akin to the Libor rate in the future.

A National Costing Committee on the production cost of metals should daily declare costing based on currency per unit, i.e., rupees per kilo of the metal. This guaranteed purity ensures accessibility to consumers or users daily at any convenient point and location in India.

Investment demand for these currencies will be speculative, with returns equivalent to the money returned to the economy, incentivizing producers to dematerialize their stocks and encouraging consumer purchase from commercial auctions or delivery points. Auctions can be held for additional quantities in exceptional circumstances.

Indian citizens should actively participate in metals and energy inputs with participation certificated backed by metal.

Daily auctions for specific quantities by holders, followed by trade on arrival indexation, would ensure economic efficiency.

The closest consumption point should become the point of reference.

Summary:

Commercial Banks need to have the capabilities to manage capital account convertibility adequately and will be the frontline troops that make foreign exchange reserves effective.

Metals, (all import equivalents) Energy inputs e.g. coal, petroleum – crude and products need to be on Indian soil at secure guarded customs bonded convenient locations suiting re-exports, consumption and convertibility will enhance competitiveness and economic efficiency.

The Reserve Bank of India may determine that all Commercial Banks and financial entities need to invest 2 percent of their DTL in approved foreign currencies, metals, energy inputs and equivalent that sustain India s needs for a sustainable period and will constitute equivalent of foreign exchange reserves and tradeable current assets. This may be initially controlled by the RBI through specific agencies and Primary Dealers as a SLR requirement. This resembles managing gold reserves by the RBI, from a national perspective as forex reserves.

Inventory should be held in Special Economic Zones, like the strategic crude reserves held by ISPRL.

A state-owned bank can be assigned the task of agency or representative of the State and RBI through a 10-year agreement between the RBI, the Government of India, and state-owned banks. Commercial banks would then handle all metal consumer transactions across India on a day-today basis.

The first transaction would occur in India from a depository, with customs duty paid by purchaser and taken delivery of through specific delivery contracts.

Global operators need to be allowed and should have the freedom to take metals out, when necessary, without obstacles, even in extreme situations.

Indian savings and capital should not be preempted for controlling inflation but utilized freely for constructive purposes and nudged towards long-term investments, while commercial banks focus on short-term transactions and payment systems.

The Forward Markets Commission has been established for approximately four decades. India has a futures market. The physical market needs to be effective or efficient.

State governments need to be proactive and protect the interests of citizens.

The entire nation needs to be addressed, with trade centers where buyers and sellers converge.

Exchanges are meant for the convergence of information, not for operating on their account but through their members. Therefore, activities of all metal markets need to converge at the most economically efficient point. Citizenship is crucial, emphasizing self-discipline and the need to establish a clear distinction in perception of media operators between –

– Control,

– Regulation, and

– Physical delivery markets.

Governance is about performance and enforcement of contracts. These need to cover social contracts of humanism.

Dispute settlement mechanisms are driven by constitutional agencies, followed by legally driven entities towards convergence and harmony.

India will have rapid progress when Governments introduce economic efficiency in every sphere –

Self-discipline and discipline need to be evident.

The role of Bharath will be established in enhanced capital account convertibility based on metals and strategic inputs and role of capital of the citizens of India.