Redemption of External Debt Outstanding of the Government of India

1. The Government of India, Parliament, and the Reserve Bank of India need to work together to recognise the difference between the external debt converted to the Indian rupees at book value and the current rates.

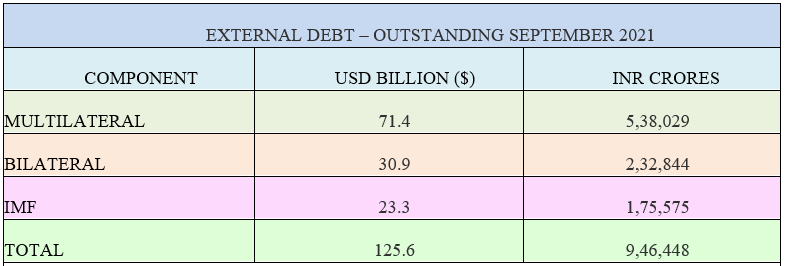

2. Table 1 reveals the external debt outstanding as on September 2021 taken from RBI bulletin.

TABLE 1

* Source: Values extracted from Reserve Bank of India bulletin

* Converted USD: INR @ 75. 3542 at 1:30 pm on 11/02/2022. Source: Financial Benchmarks India Pvt Ltd

3. The Indian government owes Multilateral, Bilateral and IMF organizations a debt to the extent of USD 125.6 billion, that is, Rs 9,46,448 crores, which requires to be repaid on due dates. These are loans at concessional rates or otherwise.

| The Government of India needs to create an International Debt Redemption Fund |

4. The Government needs to be free of debt to any Multilateral and Bilateral institutions or the IMF.

5. Parliament needs to decide that the Government of India needs to create an International Debt Redemption Fund. It can decide to allocate a nominal amount of Rs. 2500 Crores for this financial year 2022-23.

6. One of the sources for the international debt redemption fund that can be decided by Government and Parliament is the annual surpluses from the Reserve Bank of India, entirely or a portion.

6.1. It is also clearly required to be stated that the profits of the Reserve Bank of India as determined annually is a surplus allocated to the Government of India.

6.2. For the next 10 years, it needs to be solely used for economic purposes as it is solely an earning from economic activity.

6.3. The Reserve Bank of India is in a position to share this and the Government can utilize it better.

7. The liabilities of the Government of India clearly state as follows:

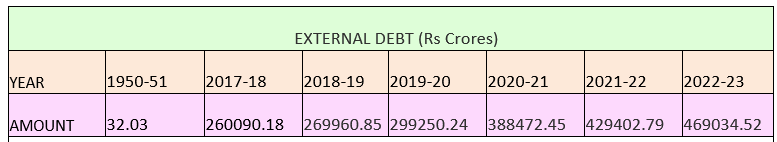

TABLE 2

*Balance according to book value

Source: Value extracted from statement of liability of Central Government from union budget India.

8. The unnoticed contingent liability of Government of India.

8.1. The Government of India does not “hedge its foreign currency borrowings in foreign currency”.

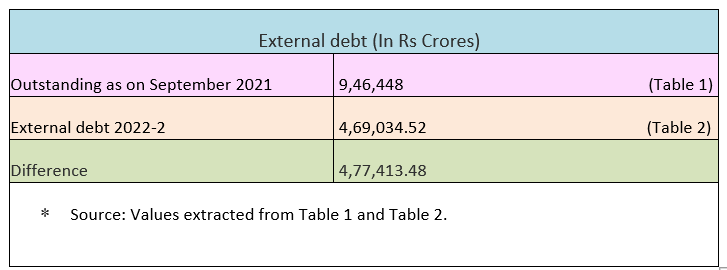

8.2. As on the date say, 31st December 2021, the Government has “contingent liability of Rs. 4,77,413.48”. This is arrived explicitly in the Table 3 below.

TABLE 3

9. Parliament needs to examine the Pros & Cons of prematurely retiring sovereign foreign currency debt of India.

Questions:

To what extent will the Reserve Bank of India and the Government of India with Parliament work together on the redemption of the Government’s Foreign Borrowings?

Is an early retirement or prepayment of the Government’s Bilateral, Multilateral and IMF loans appropriate for India, given the Foreign Exchange Reserves at Record levels?

Can the Government of India and the RBI enable current surpluses in the Global economy to create assets in India through the Financial System without risk?

If any nation in the world is condescending on India, the need for introspection is, do we need any loans or grants from any nation?

Is halting future sovereign loans a good policy? Henceforth, this needs to be a decision in principle.

Remedies

10. Parliament should address the contingent liability of the foreign exchange fluctuation risk.

10.1. It should be expressly stated to the Parliament in budget papers or in the Committee, and the Reserve bank of India should confirm it in its monthly statement.

10.2. The Reserve Bank of India and the Government of India should work together in narrowing these contingencies by introducing special measures.

11. When the pre-payment is decided:

11.1. It can be done by a Debt Swap equivalent in Rupees by issue of 364 days Treasury Bills.

11.2. On exercise of this Swap, the Government can deposit it in foreign currency with State owned banks in India till it arranges to repatriate the money in consultation with lenders.

11.3. All the lenders must agree to take back the loans before the due dates.

11.4. The repayment of dues to the International Monetary Fund should be the first one initiated by the Central Government.

11.4.1. The Reserve Bank of India is a contributory to the International Monetary Fund in its International Investments Program.

11.4.2. The Government of India can easily repay this loan and need not rely on any borrowings of IMF under a managed Foreign Exchange Reserves Program by the Reserve Bank of India, which has been carried out in an accomplished manner.

11.4.3. Indian citizens in India or internationally also need to be allowed to participate in international holdings in the form of capital account convertibility gradually developed in the next 10 years.

11.4.4. This would be a great moment for India if the Parliament and Government with Reserve Bank of India decides that IMF borrowings to the extent of Rs 1,75,575 crores be repaid with immediate effect.

11.4.5. This can be done with swap of Treasury Bills raised from the market and supported by the Reserve Bank of India in a short period.

11.5. In the case of bilateral loans, these would have been taken for a long period of 20 or 30 years with durations of 20 or 30 or 40 years. It is time that these loans be repaid or provisions made for repayment in the ensuing months.

11.5.1. Since bilateral arrangements have to be addressed diplomatically and arrangements need to be made by communications, Parliament can resolve that the bilateral loans can be prepaid.

11.5.2. It would also be a grand moment if Parliament decides with Reserve Bank of India and Government that we are at a confident level that we do not request, ask or take any loan from a sovereign government for the purposes intended.

11.6. In the case of multilateral loans, India need not resort to any loan from IBRD, ADB or World Bank or any other bank. It can rely on its own rupee sources and its savings.

In order to achieve all of this, a conscious creation of an External Debt Redemption Fund will induce and motivate public finance actions as well as recognition of this debt by the public of India to bring in a spirit of sovereignty.

12. The Government of India in forthcoming sessions of Parliament budget can create two funds –

- Redemption of External Debt Fund

- Defence Assets Acquisition in Foreign Currency Fund

13. Credits to these funds can be channeled through appropriate Budgetary mechanisms of the Central Government. One of the options is that Reserve Bank of India’s annual surplus can be a source of credit.

14. The Government of India should halt all sovereign borrowings in foreign currency. India should become investors in Multilateral institutions.

15. An internal debate in the Ministry of Finance needs to be initiated and if necessary, in the public domain, inviting public views.

16. The Government of India can decide on merits and convey the decision in principle to Parliament and the Institutions and subject itself to scrutiny in the realm of public finance.

17. The parliament Panel can convey to Government of India at the views of public.

CONCLUSION

• The Reserve Bank of India and the Government should agree to swaps that enable RBI to hold securities equal to the rupee equivalent of Government Debts and the RBI can provide the needful forex to prepay loans.

• It is therefore wise to halt all sovereign borrowings in foreign currency – multilateral or bilateral. On the other hand, the current situation in India can contribute to global development of all nations as it is meant to be.

• This will increase returns of capital in India and generate employment.